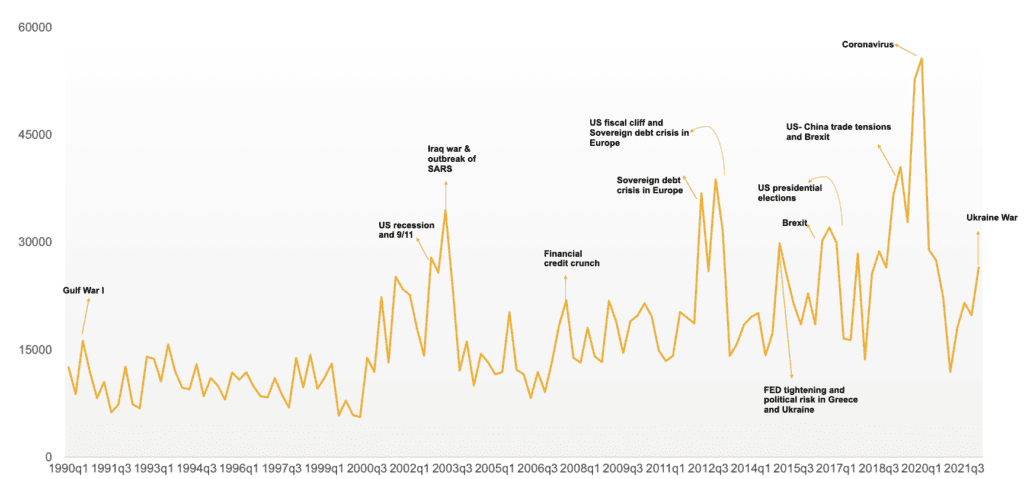

In today's world, one thing is certain – uncertainty. This notion is reinforced by the World Uncertainty Index (see Figure 1 below), which measures the level of global uncertainty across a variety of economic, social, and political factors.

Figure 1: World Uncertainty Index

Context setting: Why inflation?

By taking a step back and examining the past three decades, starting with the Gulf War in 1990, we can observe a pattern of uncertainty that has continued to plague our world.

The 2000s, also known as the Noughties, were marked by a series of uncertain events, beginning with the US recession and the tragic 9/11 terrorist attacks in 2001, followed by the Iraq War, the looming threat of SARS, and culminating in the infamous financial credit crunch and recession in 2009.

In the 2010s, the world saw the European Sovereign debt crisis, the US Fiscal cliff, BREXIT, and US-China trade tensions at their peak.

And just when we thought the worst was over, the coronavirus pandemic hit in 2020, sending the World Uncertainty index skyrocketing.

As the world began to regain its footing in the face of the pandemic, it was soon confronted with the Ukraine War, leaving us wondering what the next crisis will be — perhaps Taiwan escalations?

According to a recent Gartner report, a majority of finance leaders surveyed believe that inflation is here to stay for the next few years.

As a result, CFOs are facing the challenge of dealing with inflation. In short, uncertainty is the new norm. It's important to be prepared for whatever may come our way, and CFOs need to be ready to tackle the challenges posed by inflation.

Business perspective: Why managing Inflation is important and how smart technologies can help

Inflation has become a major concern for businesses and individuals alike, with the rate of inflation reaching its highest level in 40 years.

The impacts of inflation extend beyond individual consumers to affect enterprises around the world, leading to increasing interest rates, rising commodity prices, higher purchase prices, supply chain disruptions, and exchange rate volatility.

To manage inflation and its impact on their business, companies need the right digital technology to help them navigate these uncertain times and continue their transformation journey.

At SAP, my role is to guide finance leaders on their digital transformation journeys, and one of the key components nowadays is to manage inflation.

In the past, stand-alone business technologies lived in siloes, and data was hoarded. Business leaders often became frustrated because the right hand often had no idea what the left hand was doing. However, today, the essence of digital business systems is integration.

Data from disparate departments inform real-time actions and reporting. People and machines across a global supply chain share intel as and when it happens. Information from every corner of the business and world is centralised, secured, and accessed from anywhere — leading to greater agility and faster, more confident decision-making.

Smart digital technologies can help companies manage inflation in three ways:

1. Understanding the impact of inflation. It’s essential to understand how inflation is impacting the business's health before taking action. Smart digital technology should be able to mitigate financial risk, optimize liquidity, and improve supply chain visibility.

By assessing risk positions and gaining insights into commodity price changes and currency conversion rates, businesses can better mitigate financial risks.

They can also gain full cash visibility across the enterprise and predict cash flow with AI-enabled forecasting capabilities, optimising liquidity, accelerating cash flow, and simulating future outcomes. Improving supply chain visibility can help strengthen the supply chain, increase the return on investment, and optimise all manufacturing and logistics activities.

2. Acting quickly and proactively. Once the impact is clear, the next step is to act quickly and proactively. An integrated digital technology platform is essential for this step.

Technology should be able to unlock cash and working capital assets, uncover savings opportunities in procurement, and ensure hedging and compliance.

By unlocking cash and other working capital assets, including account payables, account receivables, and inventory, businesses can access financial programs such as dynamic discounting and supply chain financing.

They can also track and control direct and indirect spend to save costs and improve supplier relationships with real-time intelligence into enterprise-wide procurement and inventory optimisation.

Effective hedge accounting strategies can be executed with real-time visibility into FX and interest rate exposures, ensuring compliance with regulations such as EMIR and IFRS 9.

3. Preparing for what's next. Companies should be prepared for future fluctuations in the economy as uncertainty is here to stay.

Smart digital technology should provide customers the ability to get ahead of supply chain disruptions, drive down financial and material waste in the supply chain, and boost productivity.

By getting ahead of supply chain delays and downtimes, countering the rise in energy prices, streamlining materials usage, and better controlling expenses, businesses can prevent supply chain-related revenue loss and avoid unforeseen costs.

They can also run simulations and what-if analyses to identify and engage trading partners that can quickly scale up production and further drive down financial and material waste.

Empowering executives and employees to find measurable ways to automate tasks and be more productive and efficient can also boost productivity.

In conclusion, navigating the challenges posed by inflation is not an easy task for CFOs, and it requires a combination of smart digital technology and strategic decision-making.

The right digital technology can help companies navigate these uncertain times and continue their transformation journey.

From understanding the impact of inflation to acting quickly and proactively, and preparing for what's next, digital technologies can help finance leaders weather the storm and emerge stronger and more resilient than ever.

If you would like to learn more about how digital technologies can help your organisation manage inflation and build a more agile and resilient business, please don't hesitate to contact me.

As they say, the devil lies in the details, and I am more than happy to sit down with you and discuss your specific needs and challenges in greater detail.