The invoicing process encompasses much more than simply creating and transmitting an invoice. It also includes maintaining customer and product master files, generating customer billing data, transmitting billing data to customers, posting receivable entries, and resolving billing inquiries. The total process cost per invoice includes the total cost of personnel, outsourcing, systems, overhead, and other allocations to these activities.

A study by the American Productivity & Quality Center (APQC) reveals three areas where finance teams can look to reduce the cost of invoicing.

The total cost to invoice customers is an important KPI that measures the efficiency of your sales and accounting teams and the health of the invoicing process itself.

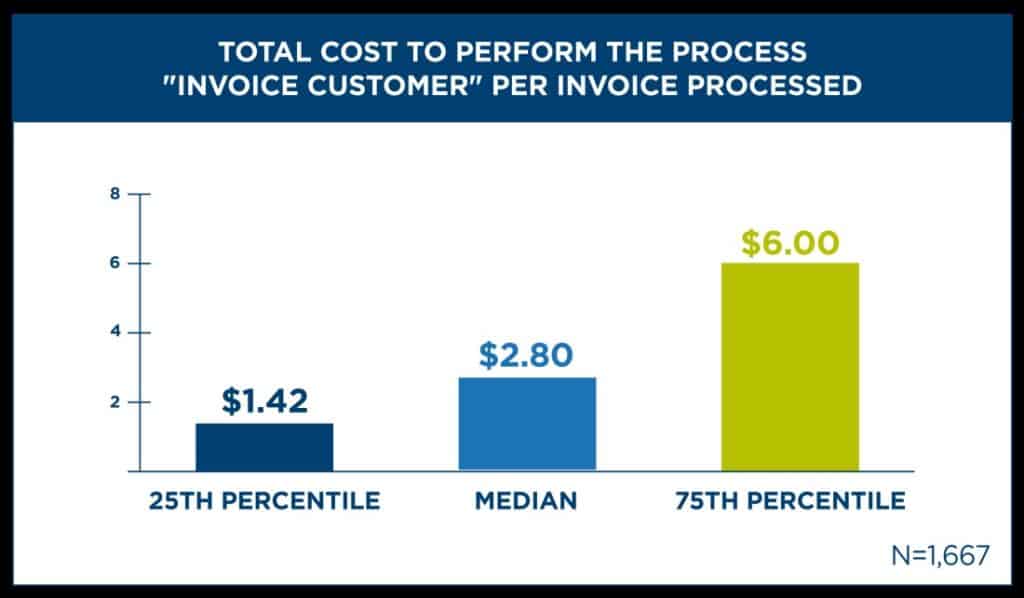

APQC finds that top performers (those in the 25th percentile) spend US$1.42 per invoice on the process, while bottom performers (those in the 75th percentile) spend more than three times that amount at US$6.00 per invoice.

Chart showing data for the metric Total Cost to Perform the Process "Invoice Customer" per Invoice Processed. The 25th Percentile is US$1.42, the Median is US$2.80, and the 75th Percentile is US$6.00.

The cost of invoicing has decreased for all organisations over the past few years. In 2018, bottom performers spent US$9.00 per invoice on the process, while those at the median spent US$3.94 and top performers spent US$2.00.

One very likely explanation for these decreases is that a rising tide of technology has lifted many boats. Automated invoicing solutions and related technologies are more accessible than they were even a few years ago. The data today reflects the gains that many organisations have been able to achieve because of adopting and implementing these technologies.

The top performers for this measure may still have some room for improvement, but there is a point at which further cost-cutting becomes counterproductive. Bottom performers, on the other hand, have the most to gain by continuing to bring costs down. For example, an organisation could potentially save more than US$450,000 for every 100,000 invoices it processes by moving from bottom to top-performer status.

A holistic approach to process improvement

If your performance on this KPI is not where you would like it to be, you should look holistically across your process, people, and technology for opportunities to bring costs down. We provide recommendations for each of these areas below.

Processes matter

Before you buy any new invoicing technology or systems, it is important to take an intensive look at the invoicing process itself. Designate a team to create a detailed process map of each activity and handoff within the larger process. Doing so will allow you to identify redundancies, bottlenecks, and other opportunities more easily for improvement that could boost efficiency and cost savings.

For example, if your organisation requires CFO approval of all invoices over US$20,000, all the necessary approvals should be obtained before the invoice reaches accounts payable.

Otherwise, AP personnel will need to spend time tracking down leadership approvals for each invoice over US$20,000, which will drain time and productivity.

Optimising the process to remove these types of inefficiencies will help you bring costs down and set the stage for technologies that will help lower costs even more.

The human cost

As the costs of labour continue to rise, it’s important to make sure that invoicing teams work as efficiently as possible. That not only means training them for your tools and systems, but also making sure that desktop guides, process documentation, and other knowledge resources are accessible to them in the flow of work. Robust training and knowledge management will help to reduce errors and rework.

A smooth invoicing process requires collaboration and coordination between different teams. Working to build a culture that values interdepartmental collaboration, communication, and efficiency not only benefits invoicing but works across the enterprise more broadly. Design opportunities for teams to collaborate, get some easy wins and have fun together to keep building and sustaining this culture.

Recurring IT challenges

A lack of integration between systems is still a challenge for many organisations and one that will keep the costs of this process higher than they need to be. When the sales team is using a different system than the billing and accounts receivable team, someone along the line will need to translate sales orders as they come into the billing system. This adds time and cost while increasing the chances of errors that require rework.

ERP systems that automatically integrate sales and accounting data are much more common and accessible than they used to be, even for smaller organisations. Armed with a fully automated system, it will also be much easier and more effective to invoice frequently or even daily rather than manually processing large batches of invoices weekly or monthly.

Small wins add up

There is no silver bullet that will instantly lower your costs and optimise your invoicing process. Bringing costs down in a sustainable way means looking holistically across your process, people, and technology for opportunities to work more efficiently and collaboratively. Many organisations have found that small improvements in all of these areas add up to make a big difference over time.