Pay raises in 2023 in Asia Pacific will be driven by tight labour market and inflation concerns, said WTW recently.

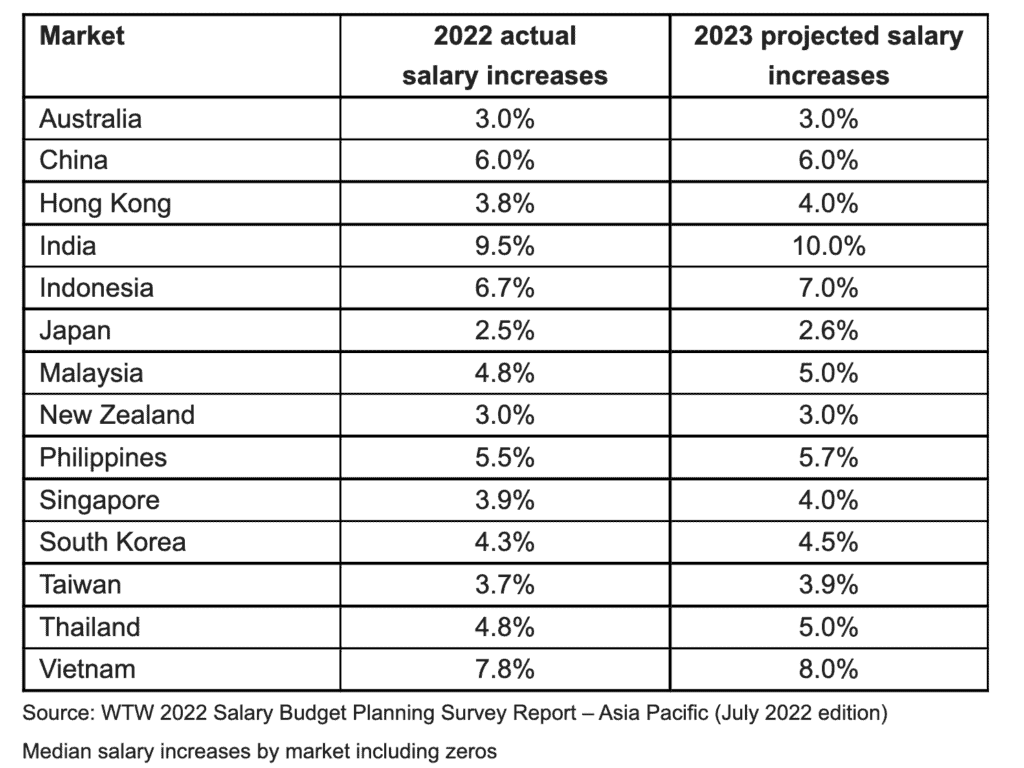

Companies in the region are budgeting an overall median increase of 5.1% for 2023 across 14 markets, compared with the actual 4.9% increase in 2022. These are the largest increases since 2020, according to WTW’s Salary Budget Planning Report.

Report highlights

- More than half (56%) of employers in the region have budgeted for higher pay raises in 2023 compared with last year.

- One-third (33%) have increased their budgets since original projections were made earlier this year.

- Half of the companies (51%) are sticking with the pay budgets they set at the start of the year.

- Some companies are also making more frequent salary increase adjustments.

- In markets such as Singapore, more than one-third (34%) have already increased or plan to increase how often they raise salaries. Among those respondents, the vast majority (95.5%) have or will adjust salaries twice per year.

- Overall, the most cited reasons for organisations reporting higher pay raises in 2023 include concerns over a tighter labour market (63%), employee expectations for higher increases driven by inflation (40%), and anticipation of stronger financial results (31%).

“Although higher salary increases are expected, various industries are showing different developing rhythms,” said Edward Hsu, Business Leader, Rewards Data Intelligence, International at WTW. “With such a dynamic environment, it’s imperative for organisations not only to have a clear compensation strategy but also a keen understanding and appreciation of the factors that influence compensation growth.”

Non-monetary actions for talent attraction and retention

According to the survey, attraction and retention challenges continue to plague organisations across the region, although fewer respondents expect those difficulties to be at the same level next year.

- Over eight in 10 respondents (89%) are experiencing difficulties attracting talent this year, but only 39% expect difficulty in 2023.

- Similarly, 86% of companies reported difficulty retaining employees this year, but that number is expected to drop to just 54% next year.

- Information Technology skills are most sought after by companies. In Singapore, more than half (53%) of the organisations are looking to recruit digital talent in the next 12 months.

- Yet these professions are some of the most difficult to attract and retain, as three-quarters of companies experienced problems in attracting (75%) and retaining (70%) them.

- In response to these issues, many organisations have taken or plan to take non-monetary actions to attract talent.

- For example, 67% of respondents have increased workplace flexibility, and 20% are planning or considering doing so in the next couple of years.

- More than half of the respondents (58%) have placed a broader emphasis on diversity, equity and inclusion (DEI), and 24% are planning or considering doing so in the next few years.

- Additionally, 43% of companies continue to enhance recruitment offers with sign-on bonuses and equity/long-term incentive awards, while over 22% are planning or considering doing so in the next few years.