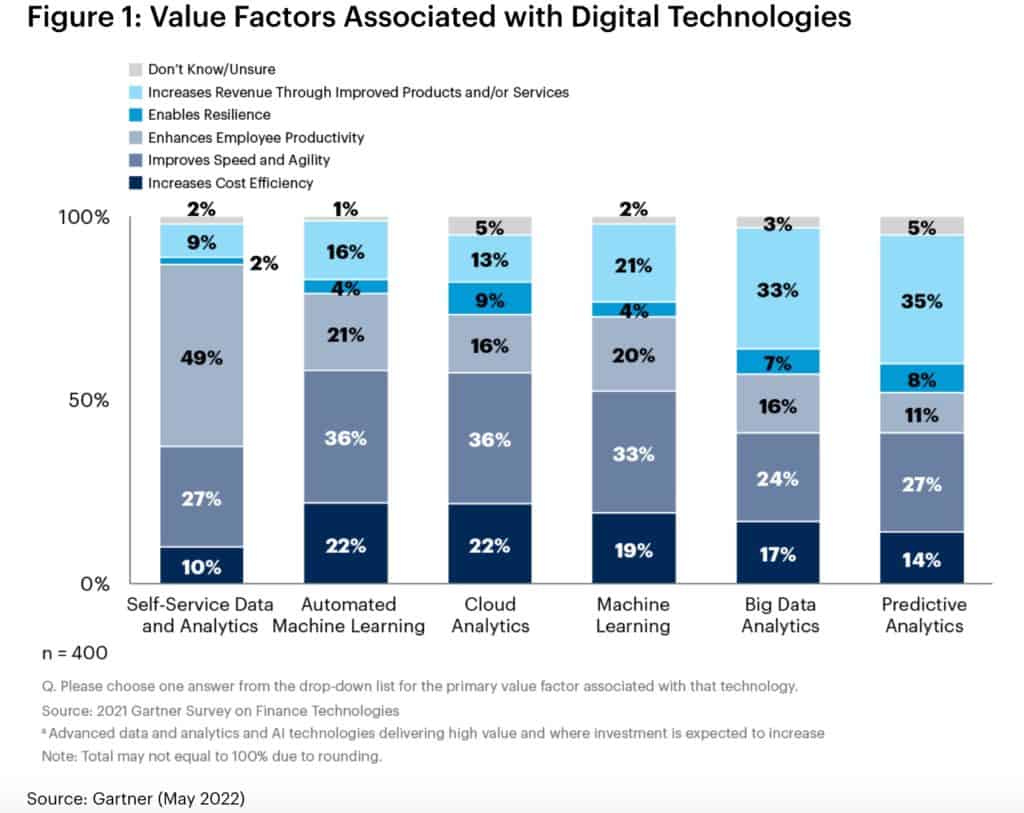

Almost half of finance executives (49%) surveyed see self-service data and analytics as a driver of employee productivity, said Gartner recently when releasing results of a survey of 400 finance executives.

At least one in four respondents saw the combination of self-service data and analytics as being a driver of increased organisational speed and agility, the advisory firm noted.

“Two out of three CFOs have raised prices in response to inflation,” said Alex Bant, chief of research in the Gartner Finance practice. “However, finding ways to improve business productivity and efficiency rather than simply passing on inflationary costs to customers will be a long-term driver of competitive advantage.”

Technologies that would see more investment

Self-service data analytics, automated machine learning (ML) and ML, cloud analytics, big data analytics, and predictive analytics are technologies that are driving high value or expected to do so and would see increase in investment.

While 94%of CFOs have greater digital ambition in 2022, they are concerned about whether this can continue in the face of slower growth, higher rates, and pressure on profitability, said Bant.

“This continued investment into digital, even as growth slows, will be what distinguishes winning companies years from now as the cycle improves,” he advised. “We call this digital deflation.”

Big data analytics and predictive analytics were the top technology categories for driving higher revenue through improving products or services, with one in three finance executives seeing clear value there, Gartner pointed out.

ML and cloud analytics technologies were seen as the best bets to improve cost efficiency with approximately one in five respondents indicating this, the firm added.

According to Gartner, the technology definitions used in the survey were as follows:

Self-service data analytics refers to technology and processes that finance users leverage with minimal involvement from IT departments.

Enabled via low-code/no-code tools in areas, such as analytics and business intelligence, data preparation, and data catalogs, self-service is now moving into other areas of data and analytics. This is because automation and augmentation impact all aspects of data and analytics.

Automated ML is the auto generation of ML models based on raw training data supplied. Automated ML is intended to increase the speed of development while minimizing the need for the model development skills of a data scientist.

Cloud analytics delivers analytics capabilities as a service and includes a combination of database, data integration and analytics tools. As cloud deployments continue, the ability to connect to cloud-based and on-premises data sources in a hybrid model is increasingly important.

Big data analytics uses high-volume, high-velocity and/or high-variety information assets that demand cost-effective, innovative forms of information processing that enable enhanced insight, decision making and process automation.

Predictive analytics are used to predict a series of outcomes over time and/or the distribution of outcomes that could occur for a specific event, using techniques such as driver-based forecasting, time-series forecasting and simulation.

Predictive analytics is one of the most popular use cases for finance executives who are automating their forecasting processes.