Refinitiv estimates that as of January 2022, the global M&A volume stood at US$5,160 billion, each with an aggregate value of US$100M or more. To be specific this does not include terminated transactions and future terminations of pending transactions will reduce the total further. But who is counting?

Rob Kindler, global head of M&A at Morgan Stanley, said the environment remains very good for M&A in 2022. “While it may not be another record year, all the key elements that made the 2021 M&A market so strong are largely in place.”

So, it looks like while the COVID-19 pandemic may have altered how M&A discussions were executed, it has not dampened the interest. Refinitiv estimates the volume has grown 58% from 2020.

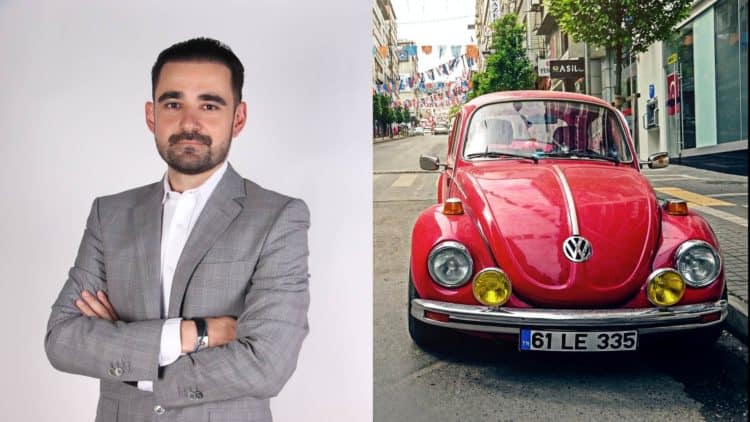

Acknowledging the evolving model for how things are done, Ali Gulsen, CFO for Volkswagen FAW Platform, observed that the pandemic significantly altered how M&As are planned and executed.

He noted that traditionally the price of the businesses (being acquired) is determined by the cash flow generated from the operations. The pandemic disrupted operations impact business’ cash flow thereby putting at risk some of these M&A deals.

“Staff communication and managing pre-acquisition the rumours are more challenging when the people cannot come to the office to work and need to work from home. The human touch is harder to establish – so does the trust when people do not speak eye to eye,” said Gulsen of the situation in the past two years. “To strengthen our communication skills, we worked with professional PR firms to give the right message across employees and customers and business partners.

Commitment essential to M&As amid the pandemic

Today, it requires more commitment to complete M&A deals as the pandemic increases the risks and uncertainties in businesses. This perseverance to stay on course is a key lesson M&A veterans have learned in 2020 and 2021.

“Times are unprecedently more challenging than ever before. To know what you want to achieve, why you want to step into M&A and with whom are key for successful M&A as for all parties to remain satisfied at the end of the process. If those essentials are set in stone and agreed across the organisation, the hiccups on the process will cause less disruption,” said Gulsen.

Gulsen also reiterated the importance of having the right partner to achieve a successful M&A amid the present situation.

“The pandemic accelerated the transfer of businesses, but not every buyer looks at the businesses for the same purposes. For example, some are profit-oriented while others are looking for their business portfolio completion.

“On the other hand, some buyers shop to control more of the industry in a single market whereas others look for consistency in the industry across the market.

“So, unless the seller does not target to exit the business in all markets, prestige and word of mouth is an important asset. Therefore, whom to merge or sell matters for the future of your business,” Gulsen explained.

Setting a reasonable timeline

Gulsen also pointed out that timing is another major element for those working on M&A deals. “Set up an ambitious but still reasonable timeline to countdown for M&A,” he said.

Above all, however, Gulsen any potential M&A must bring value creation and value capture to those concerned.

“M&A deals are not ordinary transactions. they are strategic and must be value-oriented. If it does not create value or the value-added is not measurable, it might be the wrong move to start with. Therefore, there must be a clear plan with measurable benefits to target certain gains before the search for the right partner starts,” he said.

He observed that the current pandemic has made M&As in certain industries inevitable.

“Certain industries will completely die. In some other industries, there will be major consolidations so for such cases, the pandemic made it much easier than ever before.”

* Editor’s note: Volkswagen Group Hong Kong is the recipient of the FutureCFO Excellence Awards 2022 in the category of Leadership in Mergers and Acquisitions.