Co-produced by Sukhpreet Kaur, community manager, CXOCIETY

Deloitte’s updated Finance 2025: Digital transformation in finance lists eight predictions revolving around digital technologies. Four of the predictions have automation at the heart of the prediction:

- The finance factory: Transactions will be touchless as automation and blockchain reach deeper into finance operations.

- The role of finance: With operations automated, finance will double down on business insights and services. Success is not assured.

- Finance cycles: Finance goes real-time. Periodic reporting will no longer drive operations and decisions – if ever it did.

- Self-service: Self-service will become the norm. Finance will be uneasy about this.

So what Deloitte is concluding is that automation is on its way to making life better for the CFO and the finance team (with provisos of course).

With himself deep into embedding automation into its international operations, Ross Mackay, group head of Global Shared Services and Finance Optimisation at International SOS, acknowledges the potential and promise of automation not just to make workflow easier but to do what many executives aspire to – optimise operations, reduce cost, improve efficiencies, mitigate risks both internal and external and the list goes on.

Automation beneficiaries in finance

Automation holds a lot of promises to activities that are repetitive and eventually prone to errors. Within the finance department, these activities range from collecting data to making complex decisions and counselling business leaders.

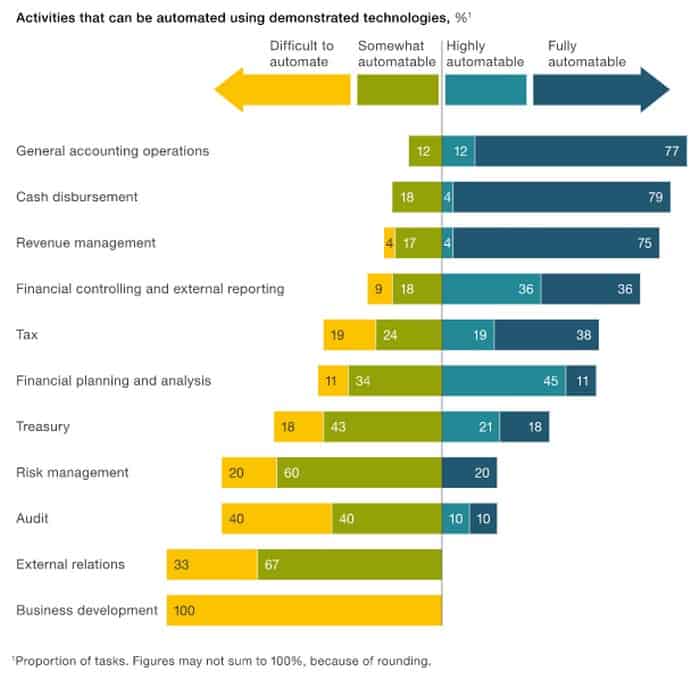

McKinsey Global Institute’s automation research suggests that up to 42% of finance activities can be fully automated (Figure 1).

“We have automated our provider Invoice capture, Operational Billing processes, Client Invoice Delivery and Accounts Receivable processes and therefore everyone involved in or a recipient of those processes has benefited positively from the automation. By removing as many manual processes in each of these processes as we could we have allowed staff to focus on checking quality, dealing with exceptions, or taking on additional activities,” said Mackay.

Misconceptions

The early days of finance automation raised concerns about job security or the benefit of changing the way of work that has been honed over years of doing the same thing.

Mackay opined an expectation in the market that these automation projects need to be big and complex posing a challenge to implementing the solution internally. While he acknowledged the contributions of the external provider/partner to help acclimatize the end-users, he also credited the internal teams that have made the automation process possible.

“As many industry experts will tell you large complex IT projects almost always fail. Therefore, we decided to split the project into multiple phases to ensure we were delivering benefits almost instantly,” he continued.

Beneficiaries of finance automation

So which functions in finance would stand to benefit the most from automation? General accounting operations, cash disbursement and revenue management were picked as the three finance subfunctions to benefit the most.

Mackay explains that the areas most perceived to benefit from automation were rule-based and voluminous. These presented clear cut cases for benefiting from automation. However, he argued that since these activities almost always involve an external party, like a customer or supplier, they do require more change management effort.

“What should not be ignored for example are largely internal processes in Finance e.g., Budgeting and Forecasting, month-end close and the numerous other reporting activities that finance functions all around the world perform for their internal colleagues,” he countered.

For MacKay automation should not be seen as an opportunity to speed up a bad process but as an opportunity to re-imagine what a process could look like with the benefit of technology – this is truly where the magic happens!

Least fit

Conversely, he felt that activities that are complex and only done a few times a year, for example, annual accounts, reporting pack, etc, may not provide the payback that finance leaders can expect in terms of time savings.

“There could be other reasons to automate though – e.g., processes that are only done once or twice a year are often where knowledge is lost first,” he added.

Lesson learned

In the report, Automation in finance functions: lessons from India and the UK, jointly published by the Institute of Chartered Accountants and India (ICAI) and the Institute of Chartered Accountants in England and Wales (ICAEW), the authors acknowledged that automation can often act as a mask over a manual and inefficient process. And that sometimes it may be better off fixing the underlying process, rather than automating it.

Still, the report concluded that automation is not an end in and on itself. It will generate more benefits when it is integrated into wider process improvement initiatives and efforts to standardise and simplify processes.

Mackay draws two lessons from his own experiences, starting with reimagining the future.

“It’s important not only to have a vision but also to partner with those involved in the processes today. You get valuable insights, energy, and ideas from your colleagues to build even better solutions. Secondly do not forget to utilise the valuable data you are now getting by automating your processes – to continue to drive improvements."

Ross Mackay

“Many organisations forget to do this and are left with the initial benefits only rather than continuing to drive additional opportunities from automation,” he warned.

Advice for those considering automation

Don’t let your finance function get left behind!

* Editor’s note: International SOS is a finalist in the FutureCFO Excellence Awards 2022 in the category of Most Innovative Use of Automation.