Global M&A to remain strong in 2022 as valuations reach historic highs, said Willis Towers Watson (WTW) recently.

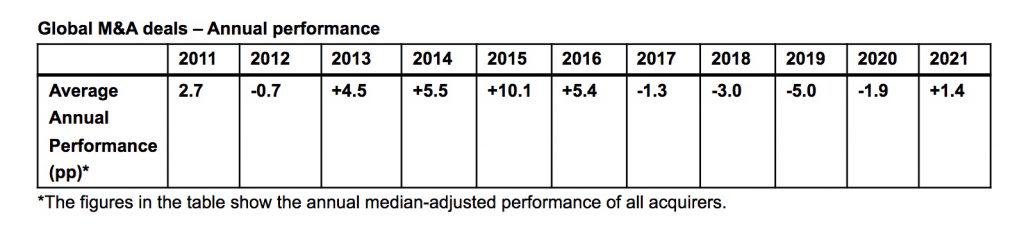

Global dealmakers achieved their first positive M&A performance for a full year in 2021 since 2016, according to latest research on completed deals from the firm’s Quarterly Deal Performance Monitor (QDPM), conducted in partnership with the M&A Research Centre at The Bayes Business School.

Based on share-price performance, companies making M&A deals outperformed the World Index[1] by +1.4pp (percentage points) on average, the firm added.

Data from the QDPM also reveals that global activity breached new highs as completed deals valued more than US$100 million reached 1047 in 2021, pointed out WTW, adding that this represents a significant increase on the previous year (674) and is the highest annual volume since our analysis began in 2008.

Highlights

- For the full year, Asia Pacific (APAC) dealmakers recorded their strongest performance since 2016, outperforming their index by +16.8pp, despite closing only fractionally more deals regionally compared to 2020 (196 vs 173), as fewer Chinese acquisitions continued to depress volume levels.

- European acquirers outperformed their regional index, showing a positive performance of +3.9pp and 199 deals closed in 2021, up a quarter on 155 deals in the prior 12 months.

- UK acquirers have consistently outperformed the FTSE All-Share index over the last five years, recording a positive performance of +5.7pp for the year.

- Deal volume in North America remained consistently strong during 2021, with acquirers closing 614 deals, almost double the 325 deals achieved in the previous 12 months, although they only outperformed their regional index by the narrowest of margins (+0.5pp).

The global M&A boom in 2021 looks set to continue, fuelled by abundant investment capital, strong equity markets and companies under pressure to make their businesses greener by hunting for targets with the right climate credentials, said Massimo Borghello, Head of Human Capital M&A Consulting, APAC at Willis Towers Watson.

M&A activity in 2022 looks poised to match the peaks of 2015, although deals will remain susceptible to increasing challenges, he pointed out.

However, high valuations, deal complexity, competition for high-quality assets and pandemic-fuelled supply chain disruption will continue to have knock-on consequences for dealmakers, he noted.

Deal speed, preparation and quality due diligence will be essential if dealmakers’ expectations are to be met, he added.

Five M&A trends for 2022

According to Massimo Borghello, there are five top trends for the year ahead:

ESG goals drive the global M&A boom

ESG priorities are climbing to the top of CEO agendas, with greater emphasis to drive employee engagement in a hybrid world of work and purchasing, rationalising or divesting assets to improve their environmental footprint.

Themes such as decarbonisation will drive deals and there will also be opportunities for new ventures stemming from climate risk mitigation innovation.

Digital transformation accelerates

Businesses have been focusing on the digital transformation of their operations for a number of years, with the pandemic increasing the speed and scale of change.

The so-called great resignation, which has forced companies to re-evaluate how to retain and acquire new talent in a scarce labour market, will continue to be a factor with companies under pressure to acquire high-end talent in fields such as cyber security and software engineering.

WTW M&A data reveals that 293 large and mega deals (those valued at more than US$1 billion) were completed in 2021, the highest number recorded as companies shaped their post-COVID future through transformative acquisitions.

This may well be surpassed in 2022 as companies and investors flush with cash continue to look for acquisitions in areas where they need to grow or add capabilities.

Supply chain-driven M&A

Many companies will aim to achieve more self-sufficiency in their products and services due to the immense strain exerted on global supply chains by the pandemic, social unrest, cyber attacks and extreme weather events.

They will achieve this through either reshoring, nearshoring or M&A by vertically integrating upstream links to improve certainty of delivery.

M&A cycles changing

Instead of declining in line with economic downturns, the unprecedented amount and mix of capital for deals from private equity firms and other investors indicates an increased capability and desire to do deals through downturns.

The rising trend to build professional in-house corporate development teams, allowing firms to identify and act on opportunities more nimbly themselves, will further enhance acquirers’ capacity to undertake M&A deals even during high volatility.

Strong M&A in 2022, but with caveats

Most dealmakers will be aiming this year to match or exceed their 2021 deal total, but they will also be concerned that inflation pressures and ESG issues could have a negative impact on deal performance.

Besides the ongoing pandemic, supply chain disruptions and talent shortages, government regulation is likely to intensify, with a focus on the technology sector. Companies will also continue to face geopolitical tensions.

“China looks unlikely to remain the powerhouse of international, cross-border deals, which may serve to stimulate activity in other places such as Japan, India and Southeast Asia,” Borghello predicted. “This trend is already evident in our data, which reveals cross border M&A activity during 2021 has remained at a steady level despite depressed deal activity from China.”