Exponential technologies such as artificial intelligence (AI), blockchain, and automation have sparked the next wave in enterprise transformation, offering both challenges and opportunities for the enterprise.

As enterprises look to embrace these technologies, CFOs and finance organizations are uniquely positioned to take their current roles of stewards of data, algorithms of measurements, and validation of benefits, to bring about the next generation of business – that of the cognitive enterprise.

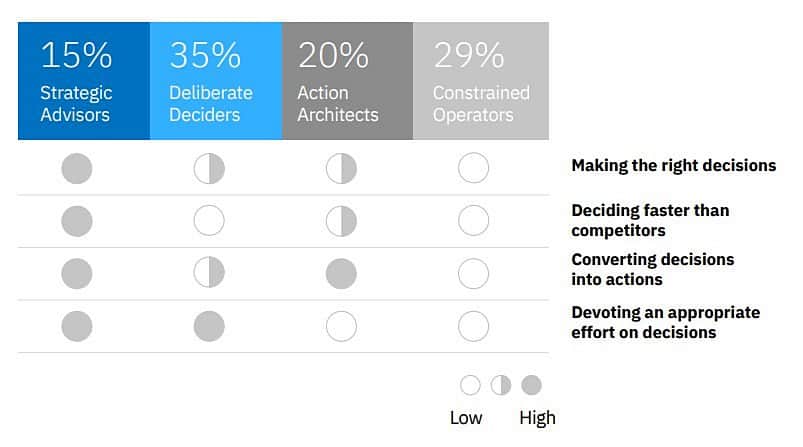

In an IBM Global C-Suite study, two-thirds of CFOs surveyed confirmed that their agenda includes taking an active role in developing strategy, driving growth, reducing costs, managing risks and providing insights.

Source: Strategic Intelligence, IBM Institute of Business Value, 2022

But about half of CFOs report their finance organizations aren’t as effective as they need to be. Finance needs to engage and weigh in much faster on emerging opportunities.

Sanjay Patil, executive partner for finance and supply chain transformation at IBM Consulting, ASEAN, says the CFO role is evolving and is now aligned with the priorities of the CEO for the organisation including improved efficiencies and customer experience.

Asked what value AI brings to the finance team, he opined that AI and advanced algorithms can help deliver insights on ways to boost financial performance.

He further posits that by using AI leaders have access to and can easily identify and articulate important financial insights enabling financial data-driven decision-making across the board.

Advancement and innovation-driven AI infuses digital transformation. Three of the four largest accounting firms have pledged to invest more in AI and data analytics products and training over the next few years so we can expect widespread adoption of modern technologies for day-to-day business activities.

As finance teams undergo their transformations, how does AI impact the transformation journey?

Sanjay Patil: AI helps automate transactions and allows finance organisations to make better decisions with the data. You get this whole new level of streamlined accounting and compliance processes.

We see better planning, budgeting, and forecasting as AI provides the flexibility, agility and responsiveness needed today in the unpredictable, fast-paced business environment.

Finance teams can analyse patterns and trends with access to better and timely data, gain new insights and respond quickly to changing market conditions.

AI as well as predictive analytics, machine learning and advanced algorithms are known to drive business performance while decreasing risk in the end-to-end compliance process and higher returns.

“Many finance functions today create economic value directly through functions like treasury activities, cash and investment management, and capital market financing. Machine learning and AI algorithms can deliver objective and predictive models to help the CFOs unlock and extract greater financial value from these activities.”

Sanjay Patil

Gartner says AI adoption in finance is still nascent. What are your recommendations for the CFO (and finance team) to ensure that AI benefits are achieved even during the early stages of adoption?

Sanjay Patil: Despite more companies investing in AI technologies and launching AI initiatives, only a small fraction gets meaningful value. Those that achieve this develop what IBM recommends as integrated AI-human systems in which AI learns from humans and vice versa.

The more different ways of learning, between the machine and the human, the more value they create.

CFOs need to think big and stay focused. Digitalisation must be ambitious, and the use of AI should be far-reaching (expansive) to drive real transformation but at the same time, don’t try to do everything at once.

Start with test projects, lay the foundation, develop capabilities, and then scale across the functions. You do not have to try everything at once. Capabilities such as AI infrastructure, talent and strategy increase the likelihood of achieving significant benefits.

Know what drives value and align your talent and resources accordingly. And make sure to track your progress and stay involved.

What questions should the CFO and finance team ask themselves and IT to ensure that everyone understands what is happening, and thereby minimise risks of unmet expectations?

Sanjay Patil: Data is critical for the application and deployment of AI. Check and avoid any bias and discrimination. Use privacy-enhancing tools (PET) to preserve the overall properties of the original data and ensure data privacy and confidentiality.

Many organisations sometimes face difficulties in justifying or rationalising business decisions and outputs mainly because they do not have a clear vision and strategy, and this impacts the adoption of AI applications.

This must be discussed internally so the AI models are auditable and transparent and put a solid governance and accountability mechanism in place.

Finally, find the right talent to embark on this journey to make sure you meet the business expectations.

Click on the PodChat player and hear Patil share his views on action items to accelerate finance transformation.

- Why is artificial intelligence important to the CFO and the finance team?

- As finance teams undergo their transformations, how does AI impact the transformation journey?

- Gartner says AI adoption in finance is still nascent. What are your recommendations for the CFO (and finance team) to ensure that AI benefits are achieved even during the early stages of adoption?

- What questions should the CFO and finance team ask themselves and IT to ensure that everyone understands what is happening, and thereby minimise risks of unmet expectations?