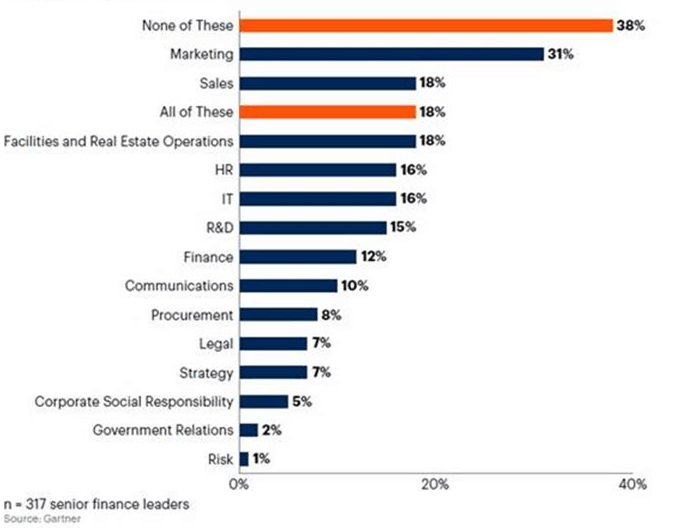

A Gartner survey of 317 CFOs and finance leaders on March 30, 2020, revealed that due to COVID-19 62% of respondents are planning some cuts to selling, general and administrative (SG&A) budgets in their organizations in 2020.

Also, 18% are planning to cut budgets in every category by at least 10%, with marketing departments expecting to be first in line for cuts of 10% or more.

Dennis Gannon, vice president, advisory for the Gartner Finance Practice said the across-the-board cuts to every category of SG&A spend often turn out to be short-sighted.

“For example, we see evidence that the coronavirus has prompted a permanent shift to more homeworking. This transition to large scale remote working puts additional strain on the IT department. Therefore, forcing the IT infrastructure group to bear the same cost reductions as another functional area could expose your organization to new risks or negatively affect business continuity,” he added.

Figure 1: Which SG&A functions will likely have their budget cut by more than 10% in 2020?

Source: Gartner (April, 2020)

Gartner recommends four cost management tactics:

Think big

Simply reducing headcount or making across the board cuts may not be the right strategy. Gartner research shows that leading companies consolidate their products and services into 24% fewer lines of business, building on the foundation of a narrower industry footprint.

“Where there is excess scope in their organization’s product or service portfolios, the hidden costs of complexity drag down profitability. The best CFOs will use COVID-19 as the catalyst to derive significant operating leverage from their most profitable lines of business without destroying value,” said Gannon.

Involve the business

Hard choices and cost-cutting initiatives cannot be entirely led by the finance team. Business and functional leaders have a greater understanding of their own departments and are therefore better positioned to identify the most effective cost-saving opportunities

Gannon suggests that CFOs and finance become facilitators and assign a business leader to every significant cash-based cost item on the P&L. “The business leader should then assemble operational, financial and process design expertise to develop and enact real cash savings strategies in their area,” he added.

Establish new leading indicators

To anticipate the extent of the slowdown caused by COVID-19 and its impact on their organization, CFOs should continuously monitor economic indicators to identify changes in the business cycle.

Gannon suggested to link trends in external market and customer data to internal business performance and KPIs. “The organizations that will come out of this crisis in leadership positions are those that quickly move resources to emerge areas of opportunity while competitors are still ducking for cover,” he opined.

Create a recurring headwind and tailwind cost report

Set up a recurring report for business leaders to capture performance headwinds and tailwinds by naming and quantifying the uncertainties in the external environment arising due to COVID-19. This will highlight the full financial implications of the pandemic and ensure a collective focus on the right indicators.

“CFOs should charge their forecast owners with producing this type of report. This will help ensure that they understand what external factors might impede or aid business performance and prepare accordingly,” concluded Gannon.