Emerging from the recent pandemic and challenged by soaring energy prices, organisations are increasingly looking to transform and enhance their efficiency and effectiveness. Finance Shared Services (FSS) is being looked upon as a strategy to deliver this much-needed transformation.

Though FSS is not new and has been growing in momentum for the past two decades, there has been an uptick in the implementation of Shared Services post-pandemic, e.g., there are 13 new set up in Greater Kuala Lumpur (Malaysia) alone in 2022 creating 2,805 high skilled regional roles as reported in InvestKL 2022 performance report. In addition, the growth of the Global Business Services (GBS) industry (of which FSS is a sub-pillar) globally is growing rapidly as indicated below.

"The projected growth of the industry from US$1.8 trillion in 2022 to US$2.5 trillion by 2025 is a reminder that Global Business Services (GBS) remains an important component of the value equation for global enterprises."

GBS: Yielding the Butterfly Effect (BCG, September 2022)

What benefits can be derived from FSS?

The true benefit of an FSS does not come from the cost savings of the Finance team, which is typically small at around 1-3% of an organisation's revenue. FSS is critical because it is an important enabler and catalyst for enterprise-wide Global Transformation initiatives which in turn position the organisation to be more agile and competitive, as highlighted below.

"GBS now find themselves taking a pivotal role in the organisation by repositioning themselves as global talent hubs leading transformation and business outcomes for the enterprise."

GBS: Yielding the Butterfly Effect (BCG, September 2022)

Through increased transparency and access to real-time data, a highly performing FSS can enable faster decision-making by CFOs in driving productivity and improved cash flow for the organisation. This is where technology tools such as Analytics play an important role.

A well-run FSS will enable the Global CFO a good night's sleep, minimising surprises on the discovery of key controls breakdown within the organisation processes.

Expansion of finance-shared services

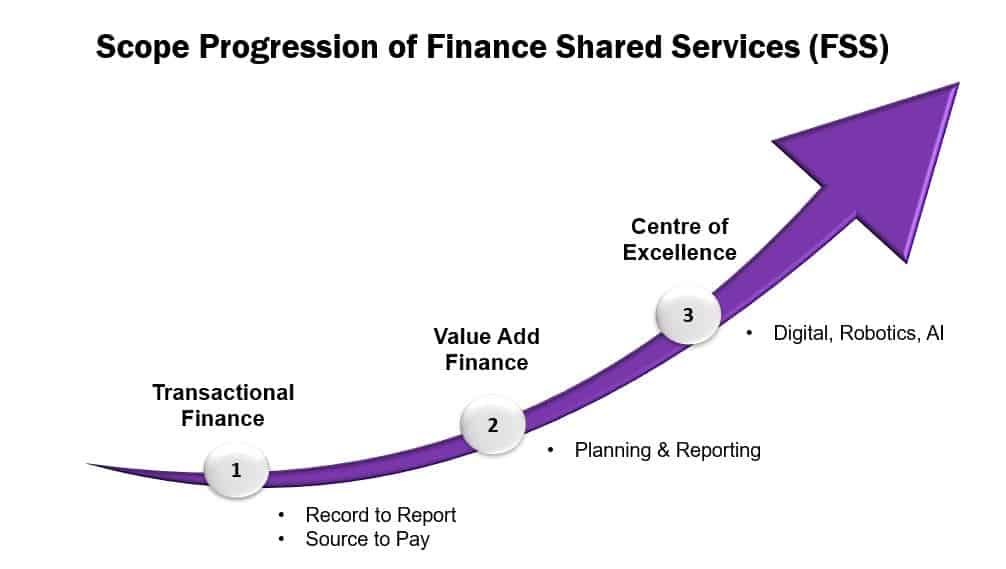

Finance Shared Services typically start with transactional activities which are voluminous and have the highest opportunity for standardisation. This involves activities within the source to pay such as invoice processing and payment as well as month-end reporting and reconciliation work.

Upon standardisation of these transactional activities, automation can be evaluated and implemented with an increased chance of success. This is a common starting point for many organisations and serves as a proof of concept before the expansion of the FSS scope of services.

The next stage of expansion involves more value-add activities by the Finance team such as budgeting and forecasting, credit management & collections, tax compliance and FP&A.

Matured FSS such as GSK, Baker Hughes and Experian have constantly pushed the boundaries and successfully increased the scope of the Finance Shared Services towards a value-add proposition for its customers.

In addition, Centres of Excellence featuring Robotic and Cognitive Centre is a new offering by Shared Services such as Astra Zeneca which requires talent with IT & Finance skillset. At this stage of the FSS expansion, a robust Service Management capability within the FSS centre is a key enabler towards its success.

How do we start?

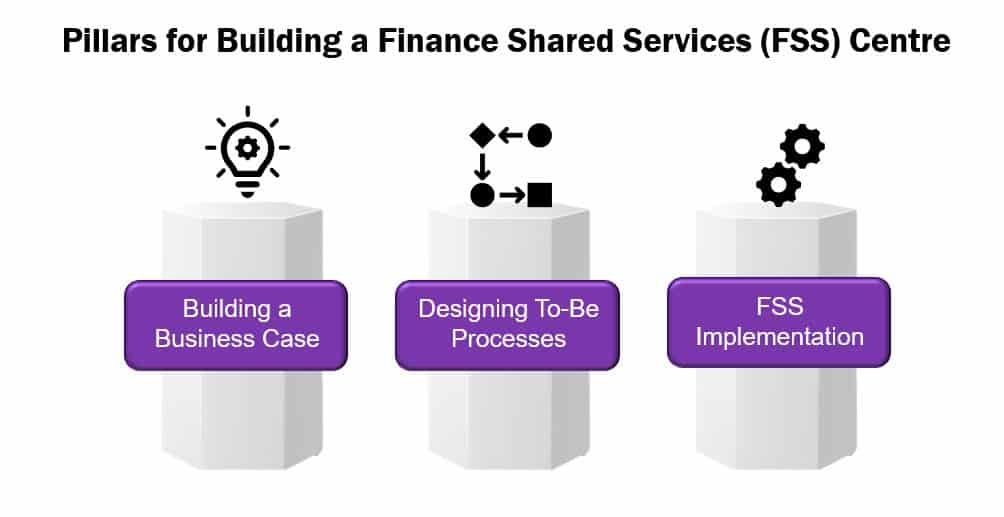

Building an overall Business Case, Designing To-Be processes and Implementation are the 3 main pillars of work in strategizing and bringing the FSS centre to life. In the Design phase, it is important to not only understand the Best Practices but also the organisation's current processes as the gap analysis is instrumental towards a pragmatic and successful implementation.

Within the implementation stage, which may take several years for large MNCs, a regional implementation roadmap with a clear understanding of lessons learnt (and adopted!) prove to be an effective method.

Pitfalls in FSS implementation

The implementation stage is where the devil is in the details and is typically fraught with complexity. Effective implementation will determine a seamless and uninterrupted service delivery. Issues arising from interrupted business operations include pro-longed delays in payments to suppliers, delays, and errors in billing customers- all leading to reputational risk and potential losses to the organisation.

Getting a team of FSS experts who can envision the future and experienced CFOs of the organisation who can manage the stakeholders as a Project Tac Team is critical towards its successful implementation.

With an increasing appetite for quick results, an FSS implementation is now often coupled with a major ERP implementation. The timing of these two big initiatives needs to be assessed, with consideration of the readiness of the people in the organisation. A "Big Bang" and "All at Once" approach may not work and may result in low employee morale, attrition, and disruption to the operations.

Conclusion

There are clear benefits from the implementation of FSS, as seen in many Fortune 500 organisations. However, CFOs embarking on this strategy need to be aware of the clear implementation challenges and understand the organisation's readiness before embarking on this strategy.

In addition, there must be a recognition that FSS implementation is a marathon and not a sprint. A good starting point is to assemble the right team and partners to successfully run this marathon together with you – side by side and ALL the way.